We have a Federal election looming with many issues coming up & the greatest issue according to MSM & politicians is how political promises are paid for.

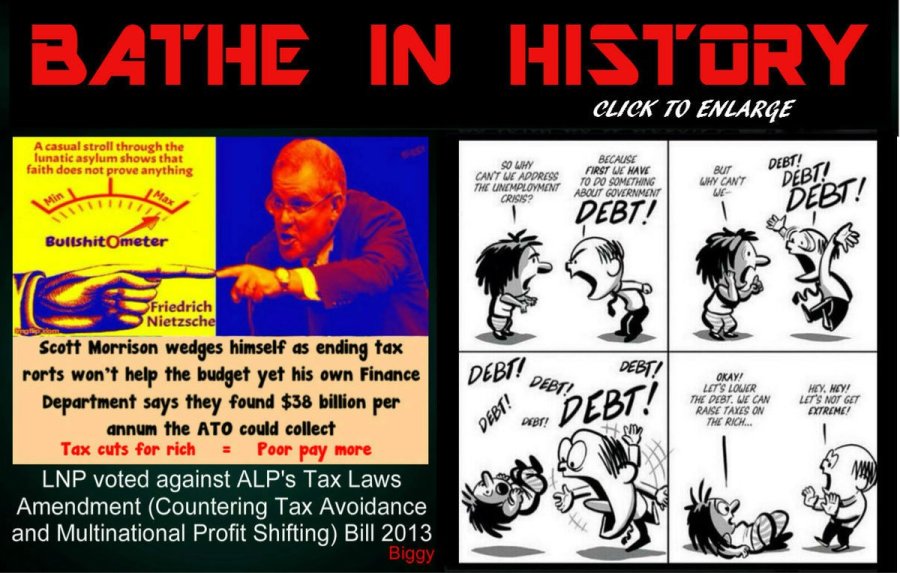

Labor tells us that by not giving $80 billion [over 10 years] in tax cuts to multinational corporations & to cut their tax loopholes there`ll be $38 or so billion annually to spend on its policies.

LOTO Bill Shorten & Shadow Treasurer Chris Bowen have explained themselves on this at the NPC on SKY & on QandA

Also clearly explained is the cutting of negative gearing for established housing [new dwellings still can claim} which will not fill the government purse even more,(properties currently being neg geared are not to be affected)

So with the $80 billion in tax cuts off the table & loopholes cut Labor says here`s a cool $46 plus billion straight up.

November 2015 figures show

The taxes that generate the most revenue are: individual income tax at $170 billion or 39.3% of all revenue collected in Australia, income tax on enterprises at $77 billion or 17.7% of all revenue, GST at $55.5 billion

Then going forward

The 2017 federal budget forecast a deficit of $29.3 billion, or 1.6% of GDP. The 2018 budget forecast a deficit of $18.2 billion. This would be Australia’s eleventh consecutive budget deficit

Now the big one

As at July 1 2018, the budget estimate of net debt in Australia was about A$341.0 billion, up from A$174.5 billion in September 2013, when the Coalition took office.

All Australia remembers the debt truck Malcolm Turnbull sat on in July 2009 >

The Opposition’s “debt truck” is back on the road as leader Malcolm Turnbull attempts to recover from disastrous polls in the wake of the OzCar affair [live linked]

The amount it said was $315 billion,so either Labor paid down $140.5 billion by Sept 2013 or that figure was gross

OK,I`ve done the intro & what I really want to know & hey,maybe others out there as well

It`s called MMT,Modern Monetary Theory

There`s been reams written on it and it is all really as clear as mud to the FAR greater majority of us

I tried to find a simplistic Australian video explaining MMT but could not,so here is an American one [but do remember the US does not own it`s Federal Reserve & has not done so since December 1913

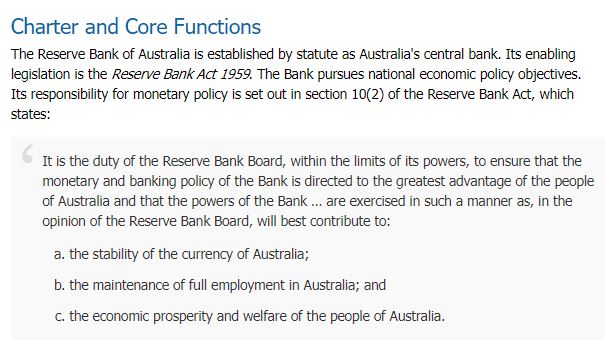

Of course we need to know how true this is because here in Australia we own our Reserve Bank of Australia,it is Sovereign & issues currency

An extract from the RBA page.

Full details > here

Today I asked Michael West if he`d compile a video explaining MMT to Australians

He replied

So readers who have watched the Youtube vid The Basics of Modern Money,please share your thoughts

I’ll see if i can get intouch with 1PeterMartin who’s a very good economist and see if he has the know all on this buddy as he no longer works for murdock he’s no longer bound by their trickle down theory

Thanks Clyde

Now you are on the right track Biggy – right up my alley – I have studied both ‘orthodox’ economics and MMT for the last 5+ years – IM(not so humble)O MMT is bullet-proof – reality based macroeconomics.

I offer that advice for what it is worth – but ask yourself Biggy, ‘Have I ever given you bad advice over the 6 or so yrs we’ve been acquainted?’

First I must take you to task on this statement: “…[but do remember the US does not own it`s Federal Reserve & has not done so since December 1913…”

That issue should not be allowed to distract from gaining an understanding of fiat sovereign currency operation and its proper management.

The US Fed Res. for all practical purposes is an extension of US treasury – it does what it is told, when it is told by Federal Congress – it is not a ‘private trader’ in any banking sense.

The entire System is subject to oversight by the U.S. Congress….’the Federal Reserve must work within the framework of the overall objectives of economic and financial policy established by the government’.

Though technically in ‘private ownership’ the US Fed Res. is structured like no other business in private ownership – all operating profits exceeding running costs are automatically (by law) remitted to US treasury. Only operating costs are paid from Fed Res ‘earnings’. A shareholding is mandatory for member banks – shares are unable to be traded. ‘Each member bank owns a share in its regional Fed, which pays a 6% dividend. All earnings above that percent go to the U.S. Treasury’ .

For all practical purposes, it is operationally a direct extension of the US government.

The Deficit Owls video you posted above is quite accurate – though I have only one minor quibble:

the depiction of a boat carrying $US dollars to China is unnecessarily misleading; reinforces a popularly promoted misconception. Physical sovereign currency never leaves sovereign shores to settle normal international trade accounts – it would somewhat less misleading if a boatload of bond/securities certificates were depicted. In practice, digital numbers in respective bank trading accounts are updated.

On videos describing MMT:

JD ALt’s ‘Millenials Money’ is a video I recommend: https://www.youtube.com/watch?v=bHQCjFebIf8

My eyes were first opened [2014] by Steven Hail’s video debunking the MSM/LNP’s deceitful ‘Debt & Deficit Disaster’/’ Budget Emergency’: https://www.youtube.com/watch?v=qBpm5sVmGYc

Bill Mitchell has produced many videos on MMT:

Thinking in a Modern Monetary Theory Way [2017 NZ]: https://www.youtube.com/watch?v=MLKrBsTQntA&t=2s

Demystifying Modern Monetary Theory [2014]: https://youtu.be/YnyDRwSqp2E

Here is basic ‘Modern Money Theory for Beginners’ from Randal Wray [US 2018]. It includes some interesting history of money: https://www.youtube.com/watch?v=E5JTn7GS4oA

I have gathered much data and relevant graphs from my research into the history of the Australian economy – happy to share same in later posts.

Old comrade John,it`s only because of your last communication with me that I decided to have another look at MMT

In the past I tried to absorb Hail`s writing but couldn`t & TBH I still feel he couldn`t successfully explain to an Eskimo why it`s so cold

When I saw that Bill Mitchell had input into the video featured in this piece I got annoyed.

The reason being is why wasn`t an Australian version done

Because unlike the USA,Australia`s Reserve Bank is a Sovereign currency issuer

(this I pointed out in the article)

I`d be happy to do digital art to your commentary to create an Australia Youtube explaining MMT ( Something around 5 or so minutes long )

As you can see clearly John,all the writing in the world has so far not gotten the MMT ideology into the main stream for discussion

The fiscal terrorists {Wall Street,Greater London etc} will not want a bar of it

…Because unlike the USA,Australia`s Reserve Bank is a Sovereign currency issuer…

That is a needless distraction Biggy – the Fed are effectively a sovereign currency issuer – where did the $25+ trillion used for QE come from?

Ben Bernanke stated on ’60 mins’ he simply marked up computer accounts at ‘The Fed’ to fund the bailouts.

Ben Bernanke: (from 0m:55s) “…this is not an issue of credit rating – the United States can pay any debt it has because we can always print money to do that, so there is zero probability of [debt] default …” – they don’t actually ‘print money’ – at the direction of US Congress, ‘the Fed’ mark-up public bank ‘reserve’ accounts using computer keystrokes.

Randal Wray has analysed the Fed’s mythical ‘independence’ here and here

Youtube video production is not my forte Biggy, others have tried with mixed fortunes – I think it may be best to compile a list of existing resources – perhaps grade them in some order – beginner to advanced.

MMT is not difficult once the concept is grasped – my son could understood the basics at 12 yrs of age!

No math other than a very basic understanding of algebraic formulas.

Many peoples eyes ‘glaze over’ at the mention of economics – but remember it is macro economics, not micro economics; the understandings necessary are mainly the functional realities of the currency system.

An understanding of money flow paths at functional block diagram level provides an adequate knowledge base to build on. Mathematical detail is rarely necessary.

iain Dooley of the Australian Workers Party made a series of MMT orientated videos over the past few years – you may remember he wrote a few AIMN articles around during that time.

His youtube channel is here.

It is very difficult to get any traction in mainstream media with MMT discussion – it is a verboten subject with all mainstream ‘journalist-economists’.

Notice the ‘cone of silence’ MSM has been imposed over Getup’s MMT based ‘Future to Fight For’ plans. Not one media discussion or report on same have I observed.

At the Guardian (Aust) there are approx 180 subscribers whose comments indicates comprehension of the basic tenets of MMT – Greg Jericho (solidly DSGE orthodox) is frequently challenged on the validity his orthodox based analysis – he has never responded to counter MMT based challenges.

Orthodox commentators all know too well they are on a hiding to nothing discussing reality based MMT – their DSGE theory in founded in quicksand. MMT is very soundly based – this Warren Mosler address to MMT proponents at a recent MMT conference is irrefutable evidence of the acceptance of MMT’s macroeconomic reality within US treasury.

MMT principles are so robust that discussion in the public arena is unacceptable risk to credibility and career.

Journo’s well know such a question invites further uncomfortable discussion of subjects they would rather leave well alone.

Mainstream commentators cannot afford to accept/adopt MMT principles, it presents unacceptable career risk; their comfortably lucrative corporate dependent media profiles depend on remaining compliant with media mogul neoliberalist ideology. It’s a case of ‘Don’t mention the war’ because it’s a certain ‘no win’ for economic journos.

MMT’s main ‘bite’ is demonstrated public loss of credibility – the inability to refute MMT realities presents an unwelcome personal moral challenge – it’s an integrity ‘litmus test’ – what then? Does one subserviently keep writing debunked economic crap, or courageously act on ‘new found’ truth and write on economic reality?

Sectoral balance math reality is also a verboten subject to neoliberal yielding careerist journo’s.

Sectoral balance math has been around for many years. Here is a .pdf from the RBA – dated 1990.

Though sectoral balance accounting relationships are not confined to MMT, they are never discussed in MSM.

I can elaborate on sectoral balance realities later.

First off John it`s not a distraction,it`s common sense so that understanding is clear .

I`ve had discussions with Iain Dooley but they too John became long drawn out affairs adding only confusion.

Then getting down further this I believe to be true ” MMT principles are so robust that discussion in the public arena is unacceptable risk to credibility and career.”

I keep saying it & I`ll never stop,I don`t care what`s gone down before in explanation,I just wish to see an Australian version of that US video in this piece explaining MMT [to create one the explanation has to be very concise}

Capitalism has lost it`s way under the current discombobulated rules-regulatory behaviour of financial services is corrupted.

We learned the truth of the GFC where the crooks were bailed out,even here in Australia the public has given the bankers a depositors security,so they can gamble as much as they want.

We know the status quo will fight with everyone`s children`s lives to defend their hegemony

I`m honestly of the belief that there is not economist that can explain how MMT will work in Australia that`s short enough to hold the viewers attention.

Prove me wrong John & do an A4 sheet sized explanation of how MMT can function

Page 2 would be an explanation of how MMT is able to just make the debt just go away-this is the big one that will be fought about during the next election- this is the one that Tories always scream loud about

OR would fixing the loopholes in how tax is collected suffice government`s needs?

Can’t agree with that Biggy, my common sense tells me the US functions as a sovereign currency issuer.

Irrespective of central bank administrative arrangements, currency is issued at the direction of US Congress; no other entity has the authority to issue US currency.

If you maintain it is not a sovereign currency issuer what is it?

Warren Mosler owned a Wall St bank – his bank (by law) had to buy Reserve Bank shares ($100,000) – they paid 6% p.a. interest; as an active shareholder, he was never once asked for input to Resv. bank management.

The shares held were effectively a ‘silent’ investment with no holder rights apart from 6% int pa, a requirement of membership.

(BTW, Warren Mosler was also an engineer – he is a near genius IMHO in his ability to analyse complex issues, then resolve those complexities down to simplest functional effect. He designed/produced a road registerable sportscar that was almost unbeatable on the track.)

MMT is not a regime to be ‘introduced’ into Australia – it is an analysis ‘tool’ which reveals the functional operations and practical effects of policy settings within our existing fiat currency financial arrangements; thus enabling selection of optimal policy settings to achieve desired social and/or national objectives.

It removes the political/ideological shrouds politicians use (at the behest of the 0.01%) to disguise the class warfare we have endured over this last 40 yrs.

MMT reveals that an unemployment buffer stock to control inflation (per NAIRU) is regressive, counter productive and austerity inducing – a buffer stock of fully employed at a basic wage (per Job Guarantee) is socially productive and economically stabilising.

Capitalism lost it`s way many years ago – unmitigated greed has infiltrated/taken over our governance structures. The US and the UK both have built a vast ‘economic’ empire through deceitful means both foul and amoral. State sponsored criminality prospers and abounds.

Michael Hudson tells it as it is here and here.

Unfortunately knowledge is not imparted through osmosis – some effort must be made by the recipient to attain knowledge. It takes discomfort or reward to generate public interest – that discomfort is looming on the horizon in the form of a housing price collapse. On my calculations, a house price index fall of 25% will bring on calamity for many over indebted households as banks impose penalties on those exceeding an 80% loan to valuation ratio.

Then we will have the public’s attention.

This diagram from Millennial’s Money video is the best I’ve seen outlining economic relationships revealed through the MMT lens – though it needs explanation for the uninitiated.

“…how MMT is able to just make the debt just go away…”

That statement concedes the neoliberal premise that a real debt exists.

MMT doesn’t make it go away, it merely reveals the so called national debt for what it really is – an ongoing investment in the fabric and people of the nation.

To quote from Warren Mosler’s video in my previous response above – “the national debt is the sum of all funds issued that have not yet been taxed back out of the economy”

In other words, it is the sum of all the money in circulation, in our bank accounts, in secured interest earning deposits/securities, all superannuation funds etc.etc.

Pay back all the national debt and no-one has any money at all.

All funds issued by the sovereign government are the debt of the government – basic stuff.

“…fixing the loopholes in how tax is collected suffice government`s needs?…”

The government does not need ‘our’ money to spend – it issues its own.

It needs us to ‘need’ their issued money; ie to provision itself, it needs us to perform works/services to earn ‘their’ money – that is achieved by requiring us to pay our taxes with ‘their’ money, or go to gaol.

Our need for ‘their money is what gives ‘their’ money its value. If we weren’t forced to need ‘their’ currency, ‘their’ currency would be valueless tokens.

Effectively collecting proper corporate taxes is about fairness and social equality – they must pay their share of the tax burden necessary to control demand (inflation) in the national economy.

The primary purpose of taxes is to restrict demand, thus control inflation pressure of too much money chasing too few resources.

That is a lot to digest i know.

OK first up the explanation differs as to US Fed RES

Here > https://en.wikipedia.org/wiki/Structure_of_the_Federal_Reserve_System

Here > https://www.federalreserve.gov/faqs/about_12594.htm

It is different to Australia`s set up

This is how it`s explained then>

how MMT is able to just make the debt just go away…”

That statement concedes the neoliberal premise that a real debt exists.

MMT doesn’t make it go away, it merely reveals the so called national debt for what it really is – an ongoing investment in the fabric and people of the nation.

To quote from Warren Mosler’s video in my previous response above – “the national debt is the sum of all funds issued that have not yet been taxed back out of the economy”

In other words, it is the sum of all the money in circulation, in our bank accounts, in secured interest earning deposits/securities, all superannuation funds etc.etc.

Pay back all the national debt and no-one has any money at all.

All funds issued by the sovereign government are the debt of the government – basic stuff.

OK here`s where contradiction jumps out at me because there`s a possibility of the whole explanation coming down to a paragraph or two.

1- “the national debt is the sum of all funds issued that have not yet been taxed back out of the economy”

(clearly explain taxed back out of our economy)

2- because 1 does not make clear sense of two > In other words, it is the sum of all the money in circulation, in our bank accounts, in secured interest earning deposits/securities, all superannuation funds etc.etc

3 – Pay back all the national debt and no-one has any money at all. [ this I can`t understand at all }

4 – All funds issued by the sovereign government are the debt of the government – basic stuff. ( this I understand )

So what I see is this,our RBA issues bonds via AOFM {The AOFM’s operations support efficient management of the Australian Government’s financing task and debt portfolio, and are influential in developing a functional and robust domestic financial market for Australia.)

Currently all AGS amounts to $535.744 billion

The bonds offered on 19th November 2018 are $1 billion worth paying 3.25% 21 April 2029 ( when these bonds are cashed in or rolled over the same principal will apply,Treasury just digitizes the money to pay the 3.25% interest and or the full principal sum at maturity ) am I correct?

TAXES

The situation on taxes is where currently the robber barons take our commonwealth storing away profits destroying the very fabric of society.

It`s clear only the wage earner pays tax as to the rich this is negligible

This places the role of government to be collector of taxes that pay for the social structure we have & the easiest way the boost our system from neo-liberal austerity is to build commonwealth owned infrastructure & services paid for by government stimulus [how Rudd/Swan did during the GFC}

As opposed to the US giving stimulus to the Fed Reserves 12 banks at $85 per mth till 2016 the $65 billion per month since

So how am I going John?

The shorter we get the answers the closer we are to achieving the simplistic explanation of MMT

Am just heading out to a Getup ‘Future to Fight For’ rally at the Town Hall tonight Biggy.

Will consider your queries and compose reply tomorrow sometime.

JohnB.

onya mate,till then

________________________________

“…clearly explain taxed back out of our economy…”

Taxed back out of the economy means any/all moneys remitted to the currency issuer (Federal Govt.) by the currency user in payment of any form of levy or tax etc.

The taxpayers ‘account’ is simply marked up to ‘account paid’; the currency received is deleted from the money supply, effectively destroyed. Tax received is never re-spent – new money is as far away as the nearest keyboard.

Old physical money (if any) reverts to its intrinsic ‘stock component’ replacement cost once it crosses to the the central bank side of ‘the counter’. e.g. a $100Au note cost C.B. approx $0.60c ea to purchase new.

“…Pay back all the national debt and no-one has any money at all…

That statement highlights the undesirability (and impossibility) of the sovereign currency issuer to clear all ‘national debt’. As all currency in circulation is the issuers debt, the only way for the issuer to be free of all debt is to recover all issued currency. If that were to occur, we citizen currency users would possess no ‘money’.

“…our RBA issues bonds via AOFM…”… to ensure the RBA’s achieves its cash rate target.

Bonds are issued (/ re-purchased) to adjust the aggregate level of money in bank reserve (settlement) accounts.

Bonds/securities are NOT issued to raise “finance”. The Fed Govt. has at its fingertips an unlimited supply of ‘keystroke’ money (that is not to say it should issue unlimited monies, it can only safely buy available idle resources; if it bids competitively for desired resources, with private sector suppliers it may cause inflation).

provide funds to finance task

Currency issuer injections/drains to/from reserve accounts are termed vertical transactions – interbank lending/repayments are termed horizontal transactions. Only the currency issuer can add to, or subtract from, total reserves,

The commercial banks interchange available reserve funds around (on commercial bid/call terms) as required to ‘settle’ each days prevailing cash transactions. Standing bank reserves earn no interest, so excess reserves are offered (bid) out to other banks in need of additional cash reserves – an interbank market rate eventuates around the RBA cash rate, depending on supply/demand.

Bear in mind that additional reserves can be ‘bought’ (via overnight bond ‘repos’) by any bank at any time from the central bank via the ‘discount’ window at a 25 point interest penalty rate.

Too much money accumulating in interbank reserve accounts drives the bank ‘inter-lending’ market rate down; too few reserves drive the interbank market rate up.

The AOMC intervenes each day (as deemed necessary) to ensure the interbank rate stays within the RBA interest target ‘window’. They achieve this target rate by buying (adding cash) or selling bonds (withdrawing cash).

“…Currently all AGS amounts to $535.744 billion…”

All outstanding securities have been paid for by the lodgement of a cash payment by the security purchaser. That cash payment is held on account of the purchaser at the central bank for the duration of the contract.

On bond redemption, the cash is returned to the redeeming entity.

More on taxes tomorrow (oops it’s today already) – later Biggy.

Hi John,I therefore take AOMC to be the AOFM,am I correct ?

So far what I`m understanding is that the current reporting on Australia`s fiscal situation to be an absolute lie,

example,people like the Kouk will tweet, “The Federal government had to borrow $1 billion today as the AOFM has issued bonds to that amount ”

Boxed

[ I am also boxing this obvious question for the future as Kevin Rudd introduced a US style debt ceiling of $500 billion,how would the government have functioned if Xbench MP`s & Greens not passed the bill tabled by the LNP?]

Till Later John

Yes – AOMC should read AOFM.

I don’t know where AOMC came from – likely a brainfade/ typo – it was well past midnight.

What I set out above is the facts – it describes everyday C.B. actions and the effect of those actions. The CB employs those transaction processes to regulate the commercial banks resv. acct cash rate.

Only facts count in my view – I have studied MMT for over 5 yrs now – I have found it never departs from the observable facts. Mosler’s claims re MMT in this video (previously posted) are irrefutable in my experience.

The issuance of a bond is in fact an asset swap – neither party is without access to the value of that asset – only the form of that asset has changed. The RBA holds cash for the duration, the bond-owner an interest earning ‘set’ deposit, in the form of a readily sale-able bond contract (on the secondary bond market). Calling it ‘borrowing’ is a stretch of the meaning of the word borrow.

When one borrows an object, one party has the sole possession/use of that object; the other party forfeits the use/possession of that same object.

In the case of a govt. bond sale both parties have access, possession and continuous use of the same object (asset), albeit in different forms.

Yes – lies abound in orthodox economic circles. The best light I can put to it is that MSM commentators/treasury officers are victims of misinformation streaming from orthodox academia. Orthodox academia persist in applying pegged/quasi gold std. currency management constraints. To some, even so called ‘progressive leftists’, ‘economic orthodoxy’ is as deeply ingrained as religious belief – Kouk, Michael Keating, John Menadue, Greg Jericho are such examples.

‘Borrowing’ constraints of course favour capital – they get the 100% secure rewards of govt. guaranteed bonds; it enables the reinforcement of false ‘common sense’ household budget analogies to Joe/Jane Public; gives plausibility to the ‘we can’t afford it’ plea from politicians when denying citizens proper levels of social spending.

Orthodox schooled commentators (consciously or subconsciously?) follow the mainstream false script that dictates a sovereign currency issuer needs to borrow from currency users to ‘fund’ new spending – it is the prevailing popular convention – to go against that convention is to go against the powerful corporatist establishment – not a popular career move. Corporatist media moguls (and the ABC !) exclude ‘rogue’ heterodox economic journo’s.

Systematic corruption of economic academia commenced in the early 1970’s – the Powell memo foreshadowed the beginning of an orchestrated campaign to regain the ascendancy of capital over labour.

Philanthropy is the most effective Trojan horse employed – gifts to universities and colleges assured corporate board positions to effect control of economic syllabus via senior staff selection.

Hence the Friedmanite Chicago School et al. That is a subject for another day.

Bill Mitchell often says “my [academic] profession is a disgrace”.

The imposition of a debt ceiling is a political decision – an artificial constraint.

Should politicians choose to place an arbitrary limits on spending, that is their conscious choice – such limits can of course be removed by reversing such political decision.

It has no bearing on the (real resource constrained) macroeconomic capacity of the nation to serve citizens – other than to willfully/voluntarily disrupt the nations monetary flows to further some political objective.

The govt. simply cannot function without monetary supply – successful denial of supply for ulterior motives constitutes political blackmail – an election must result in my view.

There is no valid reason to limit the deficit – the deficit level per se is irrelevant. The only right (proper) fiscal balance is the fiscal balance sufficient to deliver full employment and prosperity to citizens. The ‘number’ is meaningless – any number is sustainable provided a nations real resources remain sustainably available.

In fact, there is no need for a sovereign currency issuing nation to issue (corporate welfare) bonds. The nation could choose to pay a fixed rate of interest (or zero interest) on bank reserves. The corporates and investment funds would scream blue murder of course, however the govt. could ensure purposely designed legislative measures in place to support worthy institutional investment funds, while denying legions of speculative parasites govt. welfare assistance.

p.s. Biggy … already I posted this comment about 2 hrs ago – but it didn’t show up on FD as ‘posted’.

Should it be a repeat comment, please delete the prior post.

JohnB

Thanks for bearing with me on this fiscal explanation John,you have great patience,you would make a great psychologist TBH

OK,the drift I sincerely get is there is no simple explanation because MMT itself is finding itself not accepted in the current economic hegemony,that is the operative phrase because unless we have another massive GFC event that the public rails so hard against the status quo forcing change.

I have always admired Yanis Varoufakis & I wondered why Syriza failed,even when Greeks voted Oxi

The same goes for Brexit

So I availed myself of Yanis Varoufakis: Is Capitalism Devouring Democracy? & realize why we are where we are.

Thank you for all your efforts on this,and hey I do understand how MMT works,it`s just we are not ready for it economically, because the rulers of the fiscal world won`t let the politicians change it,yes,bankers rule the world,their politicians mostly jump at their directions.

Enjoy the video John

I have viewed the Varoufakis video you posted a few times over – the well meaning presentation, passion and commitment to social equity of his narratives is persuasive and convincing; but only to a lay audience unfamiliar with irrefutable macroeconomic realities that MMT reveals.

MSM have pre-conditioned Joe/Jane Public to accede to falsely based neoliberalist economic argument – however, Yanis arguments are intrinsically distorted by his inability to escape his orthodox economic academic training – the narrative he presents is rich in neoliberal based false logic.

Yanis Varoufakis, in his unwitting reiteration of orthodox economic ‘norms’ is part of the very problem he bemoans – the ineffectiveness and divisiveness of the left against a powerful organised corporate foe.

Robert Reich (US), Chris Bowen, Jim Chalmers, Michael Keating, labor’s ‘progressive’ TAI are a few others similarly afflicted with deeply ingrained neoliberal economic beliefs that render their best efforts to deliver ‘social justice’ self defeating – and damaging to ‘the lefts’ cause.

if you wish I can post a point by point refutation/analysis of many of Yanis’ key points. Much of his macroeconomic logic/analysis is based on false premise – deeply rooted in orthodox economic academia.

He is unwittingly part of the problem he is striving to resolve.

Had he a better understanding of MMT, he would have insisted on Greece leaving the EU common currency.

Greece cannot survive in a financially un-federated common currency arrangement that is the EU.

Ask yourself this question – if currency federation was removed from Australian governance how would Tasmanian’s fare?

p.s. my ‘November 19, 2018 at 2:53 pm’ comment above is still indicating ‘in moderation’

John B

It`s staying in moderation John because just like all the other explanations of MMT I`ve seen it`s another set of fiscal discipline that will not be accepted,indoctrination or not

My exercise was to simplify the explanation of MMT & this i have sought for several years now

Proponents have no simple explanation because it requires the dismantling of the financial sector as we know it.

I` not saying that`s a bad thing because it`s an oligarchs dream,but short of global war it`s not happening

Tell me which part of Shauble`s remark to Varoufakis you did not understand

“Elections cannot be allowed to change economic policy”

Thanks for your input John